michigan gas tax increase 2021

An assessment by Multistate Associates a state and local government relations firm says that there is a significant risk that Michigan raises taxes in 2021. Here in Michigan the debate over road funding is going back to a familiar off-key chorus.

Fuel Tax Rate Changes In Effect Jan 1 Land Line

Diesel Fuel 263 per gallon.

. Referred to the House Tax Policy Committee on November 30 2021. Diesel Fuel 272 per gallon. Introduced by Rep.

An analysis in June by the nonpartisan Tax. In July 2020 the DC. 15 Gas taxes thus accounted on average for.

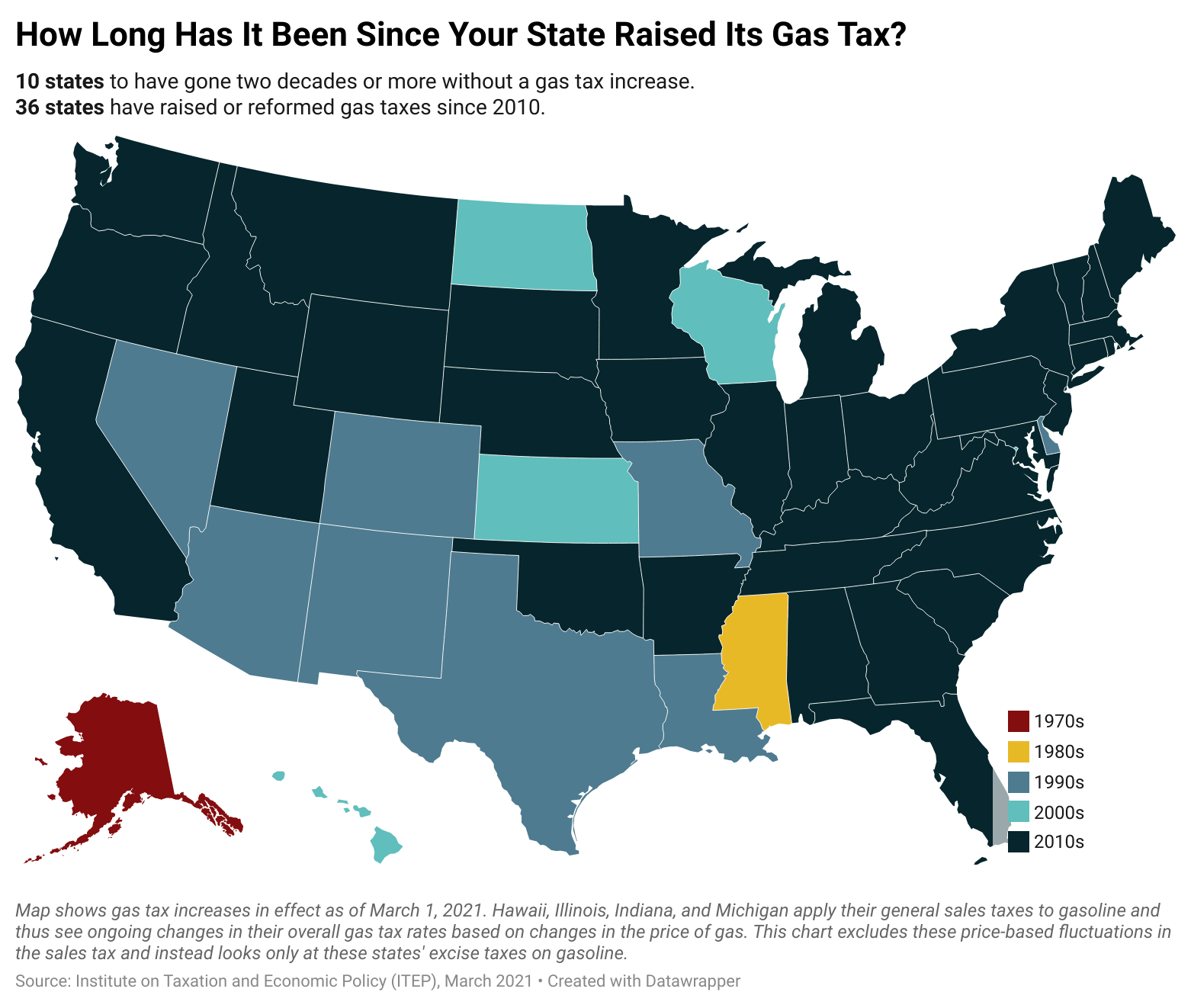

10 states to have gone two decades or more without a gas tax increase. The current state gas tax is nearly 50 cents per gallon. 36 states have raised or reformed gas taxes since 2010.

Gasoline 263 per gallon. Motor fuel taxes are levied on quantity. Talking Michigan Taxes.

So far in 2021 inflation has been unusually high. Additionally the rate will be annually adjusted based on the greater of the annual change in the CPI or zero thereafter. Liquefied Natural Gas LNG 0243 per gallon.

Throw in the 184 cent federal tax and the total gas tax rises to nearly 50 cents per gallon. This week the MPSC approved an 84173000 rate increase nearly 111 million less than the original request. Steven Johnson R on November 30 2021 To repeal an annual state gas and diesel tax increase based on the inflation rate for the past year which was imposed with a general increase in these taxes in 2015.

Matt Helms 517-284-8300 Customer Assistance. 4198 cents per gallon 140 greater than national average 2021 diesel tax. Aug 23 2019.

An assessment by Multistate Associates a state and local government relations firm says that there is a significant risk that Michigan raises taxes in 2021. Michigans 263-cent state gas. For fuel purchased January 1 2022 and after.

As such a 45-cent increase would bring Michigans total average gas tax to 8913 cpg by far the highest in the nation and over 30 cents higher than in Pennsylvania which currently has the highest gas tax 587 cpg. Gretchen Whitmer proposed a large tax hike. Michiganders would be paying double the state taxes they currently pay at the pump.

Gasoline 272 per gallon. The current state gas tax is 263 cents per gallon. A 47-cent gas tax increase would give Michigan the highest tax at the pump in the country at 73 cents plus the 6 percent sales tax which doesnt go to roads.

Its been said that history doesnt repeat itself but it does rhyme. FOR IMMEDIATE RELEASE Dec. Federal excise tax rates on various motor fuel products are as follows.

The exact amount of the 2022 increase will depend on the inflation that occurs between Oct. 4318 cents per gallon 141 greater than national average Total gasoline use. Passed by the state Legislature in 2021 the Climate Commitment Act Senate Bill 5126 directs the Washington State Department of Ecology to develop and implement a statewide cap-and-trade program to cut carbon pollution by requiring emitters to obtain emissions allowances equal to their covered.

And the states gas tax as a share of the total cost of a gallon of gas stood at 177 percent. The authors create an interesting framework to highlight some factors that lead to tax hikes and Michigan triggers a number of them. 1 2020 and Sept.

Official Text and Analysis. Senate Minority Leader Jim Ananich wants to cut the 6 fee for one year. A 45-cent tax increase per gallon of gas.

Drivers started Thursday morning with gas at 479 a gallon for regular. They note that the governor supports increased taxes. In Metro Detroit the average price is higher at 328 per.

The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. It will have a 53 increase due to a. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon.

In 2021 at a total of just over 45 cents combined per gallon Michigans gas tax was among the highest in the country at number 9 according to kiplinger. 4862405 gallons 4381530 highway 480875 nonhighway. Council approved an increase to its motor fuel tax rate calling it the Motor Vehicle Fuel Tax Amendment Act of 2020 This increase will total 103 CPG by October 2021.

WJRT -- Gas prices increased by 20 cents in a matter of hours around Mid-Michigan. Withholding payments which generally represent the. Alternative Fuel which includes LPG 263 per gallon.

Net income tax revenue totaled 13 billion in June 2022 a 121 increase from June 2021 and 724 million above the forecasted level. As of January of this year the average price of a gallon of gasoline in Michigan was 237. In October Bill Schuette accused Gretchen Whitmer of supporting a 20-cent gas tax hike to fix the damn roads.

Revenue from the Michigan gasoline tax broke 1000 million for the fifth time in the last 12 months. Map shows gas tax increases in effect as of March 1 2021. For fuel purchased January 1 2017 and through December 31 2021.

The rates approved today include 38 million for an infrastructure surcharge previously. The increase is capped at 5 even if actual inflation is higher. Hawaii Illinois Indiana and Michigan apply their general sales taxes to gasoline and thus see ongoing changes in their overall gas tax rates based on changes.

When the gas tax increase kicks in just months from now Michigan residents will find themselves paying as much as 14 cents more per gallon. Potential Increases and Reforms in 2021 Mackinac Center Policy Forum Virtual Event At the beginning of the last legislative term Gov. The authors create an interesting framework to highlight some factors that lead to tax hikes and Michigan triggers a number of them.

She called that claim ridiculous. 0183 per gallon. Whitmer said her proposal would raise 25 billion for roads though budget documents pegged the net new revenue at 21 billion in 2021.

Gas prices in the state hit a new 2021 high last week at 321 for regular unleaded. A House Fiscal Agency analysis released Thursday said the. The increases rate will show up on customers bills starting Jan.

In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247. With gas averaging 520 in Michigan lifting the sales tax would lower the price by about 31 cents a gallon. The Michigan Public Service Commission today approved an 84173000 rate increase for DTE Gas Co.

Michigan Gas Prices Continue Downward Trend Drop 11 Cents

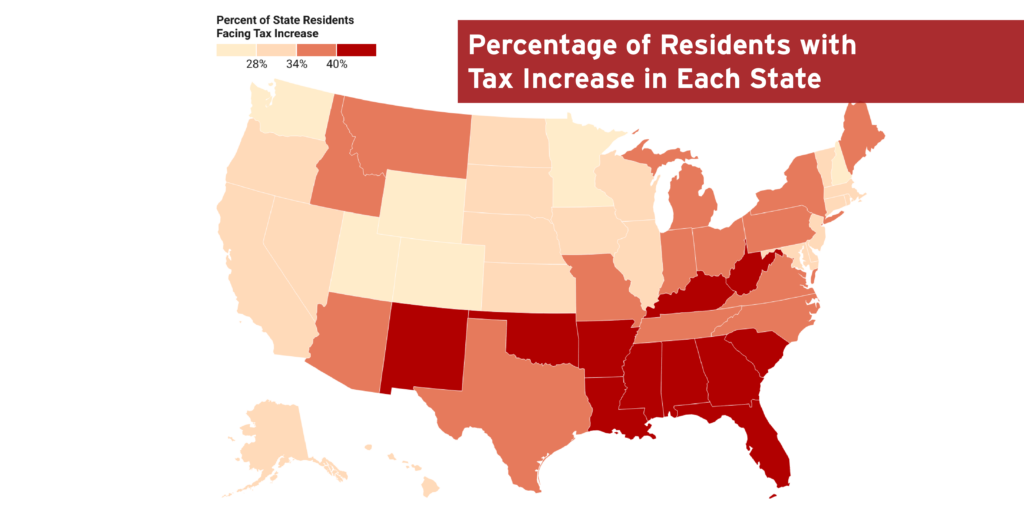

State By State Estimates Of Sen Rick Scott S Skin In The Game Proposal Itep

Gas Taxes Get Rolled Back Across U S As Pump Prices Soar Above 4 A Gallon Bloomberg

Gas Tax Holiday Could Backfire On Democrats

Michigan Gas Prices Continue Downward Trend Drop 11 Cents

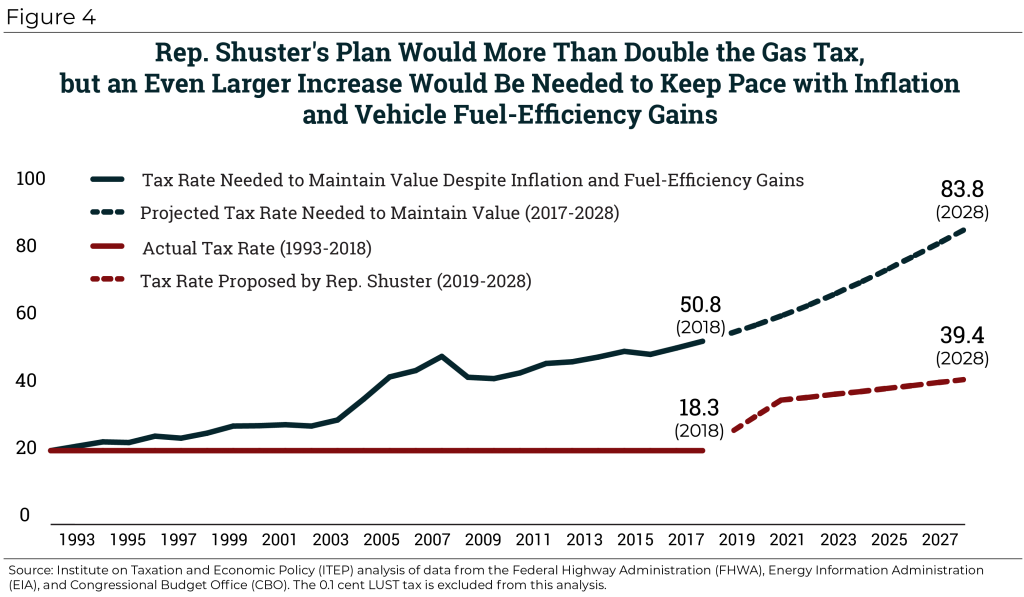

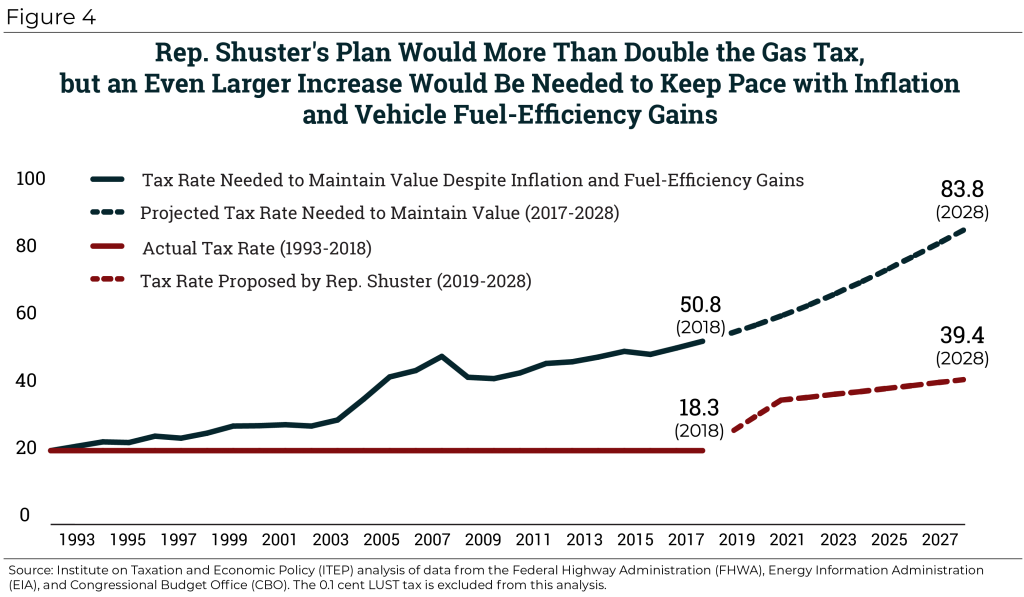

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

Desantis To Ask State Lawmakers To Cut State Gas And Fuel Taxes By 1 Billion To Offset Rising Gas Prices Florida Thecentersquare Com

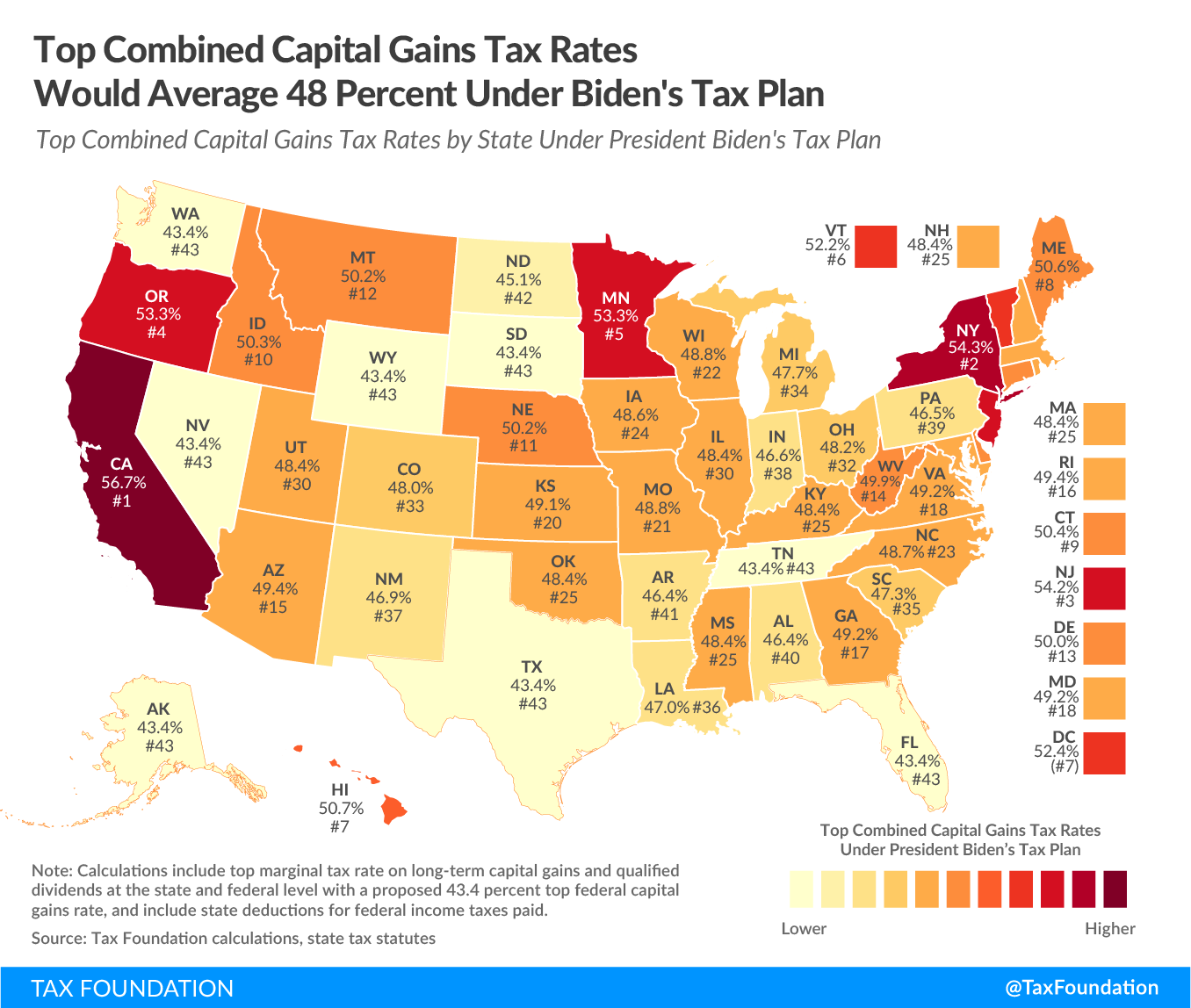

Combined Capital Gains Tax Rate In Michigan To Hit 47 7 Under Biden Plan Michigan Farm News

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

Indiana Gas Tax Increases By 10 Making It Highest In State History Abc7 Chicago

What State Has The Highest Gas Prices Where Are Gas Prices The Lowest As Usa

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

/pumpgas-5ae60d0beb97de0039a2f57a.jpg)

Gas Taxes And What You Need To Know

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

Iowa Gas Tax Holiday Appears Unlikely As Prices At Pumps Rise The Gazette

Gov Whitmer Tie Gas Tax Suspension To One Of My Tax Relief Plans